Digital health primarily refers to the use and use of digital technology to manage various healthcare problems and improve the wellness sector. Telehealth, mHealth Apps, Connected Medical Devices & Services, Electronic Health Records (EHRs), Electronic Medical Records (EMRs), Remote Patient Monitoring, Healthcare Analytics, Digital Therapeutics, and other categories are all part of the global digital health landscape.

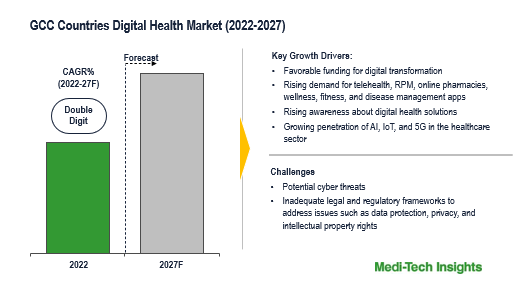

Government initiatives and the foray of several health tech startups trigger the growth of the GCC countries’ digital health market.

Saudi Arabia contributes for nearly 60% of GCC healthcare expenditure, and healthcare is still a top concern for the Saudi government. In Budget 2023, Saudi Arabia intends to invest $50.4 billion (SR189 billion) in Health and Social Development. A higher portion of this funding is expected to be spent on digital health to increase patient accessibility, efficiency, outcomes, and transparency throughout the healthcare ecosystem.

The Saudi government is focusing on preventative healthcare services and intends to digitalize 70% of all patient activities by 2030, reducing the country’s reliance on hospital treatment.

Get Detailed Insights on GCC Countries Digital Health Market Report with a Sample PDF @ https://meditechinsights.com/gcc-countries-digital-health-market/request-sample/

The foray of many health tech startups such as Cura Healthcare, Nala Health, Altibbi, Ynmodata, Labayh, etc. in Saudi Arabia and UAE is also driving the growth of the digital health market in GCC regions. Advanced digital healthcare technologies such as artificial intelligence(AI), Internet of Things (IoT), and Big Data Analytics are rapidly being integrated into all the major healthcare segments to further predict, prevent, and manage all healthcare diseases effectively.

UAE is aggressively implementing electronic health records in its healthcare and medical care. It further maintains a comprehensive, integrated, and paperless health record “Wareed” which reduces all the medication errors and long hospital stays, which was also improved with the introduction of the new service ‘ClinicalKey‘. UAE is negotiating discussions with private database service providers such as Cerner Corporation, Epic Systems, and InterSystems to unify and develop an integrated medical record with all public and private data linked. The UAE government is actively supporting telemedicine and has introduced many telemedicine facilities and has collaborated with many leading private healthcare companies. The Telecommunications Regulatory Authority (TRA) of UAE has provided its green signal to all companies to provide their telemedicine solutions in UAE.

As part of the Public-Private Partnership Model, GE Healthcare, the Ministry of Health and Prevention, and Abu Dhabi International Medical Services have come together to form ‘Unison’ – UAE’s first public sector teleradiology capability to bring major changes in the UAE healthcare ecosystem.

The Ministry of Health and Prevention in the United Arab Emirates intends to launch a comprehensive “Smart Digital Health” regulatory framework by the end of 2023, which will need all healthcare service providers in the country to provide at least one form of remote service. These remote service include consulting, prescribing medications, monitoring patients or performing robotic surgeries.

Rapid Growth in the GCC Countries Digital Health Market Post Covid-19 Pandemic

Due to strict government rules and regulations on social distancing norms during the COVID-19 pandemic, GCC countries had seen a sudden rise in the utilization and applications of online and virtual care solutions, such as online doctor consultations, e-prescriptions, online pharmacies, remote patient monitoring (RPM), etc. which is projected to be the new trend in the Arab world. The COVID-19 pandemic had also created a growing environment for all digital health startups. The region had seen the rapid emergence of many health tech startups during and post COVID-19 pandemic.

“Post Covid-19 Pandemic, in order to improve patient experiences and enhance the quality of care, adoption of digital health increased manifolds in key regions such as Saudi Arabia. Growing number of Saudi-based companies such as Nala Health and Cura Healthcare which provides online consultations to tailored digital care programs. Also, to abolish the need for physical hospital visits, Saudi Arabia’s Ministry of Health (MoH) has launched apps such as Mawid, Tabaud, and Seha, which provide virtual consultations.”-Partner, UAE-based Venture Capital Firm

Competitive Landscape Analysis: GCC Countries Digital Health Market

Some of the leading and established players operating in the GCC Countries digital health market are listed below: –

- 3M

- GE HealthCare

- Philips

- InterSystems

- Cerner Corporation

- EPIC Systems

- Altibbi

- CURA Healthcare Pvt Ltd

- Nala Health

- لبيه | Labayh

- AlemHealth

- Okadoc

- Vezeeta

- GluCare.Health, among others.

The GCC Countries’ digital health market is set to gain consistent momentum in the upcoming years with an increasing digitalized healthcare environment, growing demand for telehealth, virtual visits, mHealth and remote patient monitoring, emerging trend of online pharmacies, online fitness classes & diet-management apps, condition-management & mental well-being apps, growing adoption of wearable medical devices, rising investments in the healthcare-IT sector, product developments by key market players, and organic and inorganic growth strategies adopted by the leading market players.

Favorable Funding Environment Triggers the Growth of the GCC Countries Digital Health Market

In recent years, the GCC region has witnessed a significant rise in the fundings for digital health startups which is further estimated to drive the growth of the GCC Countries digital health market.

For instance,

- In June 2022, WEMA Health, a digital health startup, launched its services in UAE after raising $3.50 million in a seed funding round led by Dawn Health, Europe’s digital health company. The company offers a virtual obesity membership to help all its members to lose up to 20% of their body weight.