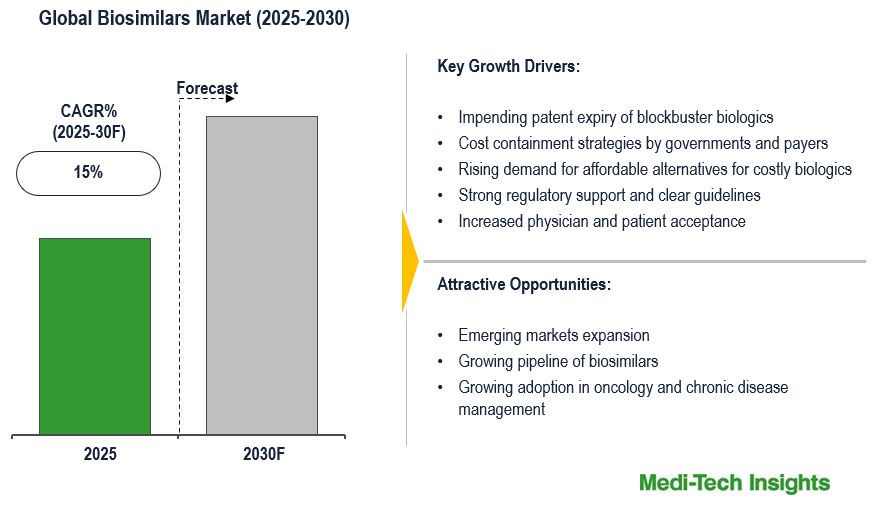

The global biosimilars market is set to witness a CAGR of ~15% in the next 5 years. Impending patent expiry of blockbuster biologics, cost containment strategies by governments and payers, rising demand for affordable alternatives for costly biologics, strong regulatory support and clear guidelines, and increased physician and patient acceptance are some of the key factors driving the biosimilars market.

Biosimilars are biologic medical products that are highly similar to an already approved original biologic (reference product), with no clinically meaningful differences in safety, purity, and effectiveness. The development of biosimilars is complex because, like all biologics, it involves use of living cells and complex manufacturing processes. Therefore, while biosimilars are similar to the reference biologic, they are not identical. The manufacturer must perform an extensive analytical, preclinical, and clinical evaluation to demonstrate similarity. Biosimilars are not just generic alternatives to expensive biologics; instead, they are a viable and reasonable cost alternative to the original biologic, particularly when the reference product’s patent has expired. Biosimilars are widely used in the treatment and management of chronic and life-threatening diseases, such as cancer, diabetes, and autoimmune diseases. They help improve access to advanced therapies available globally for patients.

Download a free sample report now 👉

https://meditechinsights.com/global-biosimilars-market/request-sample/

Impending patent expiry of blockbuster biologics to drive market growth

The impending patent expiries of best-selling biologics is a key factor driving growth of the biosimilars market. A major opportunity for cost savings remains untapped, as many high-value biologics nearing the end of patent protection and exclusivity still lack biosimilar development, delaying broader market competition and affordability. These revenue-generating biologics will be losing exclusivity and allowing biosimilar manufacturers to introduce products at lower costs in the biopharmaceutical market. This leads to competitive pricing, increases the number of patients receiving access to biosimilars, and reduction in overall healthcare costs. With most top-selling biologics nearing, if not already passed, patent expiry, companies are investing into biosimilars to take benefit of this opportunity. Regulators have also promoted a favorable environment for biosimilars during this timeframe by updating their approval pathways, leading to an overall acceleration of biosimilar entry into the market when the patent expires.

Strategic partnerships and market consolidation – A key market trend

Partnerships and market consolidation is a key trend shaping this market as this to decrease development costs, share risks, and launch products in a timely manner. Partnerships involving global pharmaceutical companies and local firms, contract manufacturers/developers, and biotech firms allows them to combine their abilities which helps to gain advanced technology, knowledge of the regulatory pathway, and existing infrastructure network for distribution. For instance, in May 2025 Alvotech expanded its biosimilar partnership with Advanz Pharma and added 3 new biosimilar candidates. Similarly, in July 2024, Evotec SE extended its biosimilar strategic partnership with Sandoz. Furthermore, the mergers and acquisitions taking place in the biosimilar marketplace are facilitating consolidation in the competitive landscape, enabling companies to scale operations and diversify their portfolios. Thus, partnerships can expand their worldwide reach, streamline production processes and support commercialization in the competitive and regulated biosimilar sector.

Competitive Landscape Analysis

The global biosimilars market is marked by the presence of established and emerging market players such as Sandoz Group AG, Pfizer Inc., Amgen Inc., Teva Pharmaceuticals, Inc., Biocon, Eli Lilly and Company, Celltrion Inc., Fresenius SE & Co. KGaA, Samsung Bioepis, and Dr. Reddy’s Laboratories Ltd.; among others. Some of the key strategies adopted by market players include new product development, strategic partnerships and collaborations, and geographic expansion.

Download a sample report for in-depth competitive insights

https://meditechinsights.com/global-biosimilars-market/request-sample/

Global Biosimilars Market Segmentation

This report by Medi-Tech Insights provides the size of the global biosimilars market at the regional- and country-level from 2023 to 2030. The report further segments the market based on product, application, and manufacturing type.

Market Size & Forecast (2023-2030), By Product, USD Million

- Monoclonal Antibodies (mAbs)

- Insulin

- Granulocyte-Colony Stimulating Factor (G-CSF)

- Erythropoietin

- Human Growth Hormone (hGH)

- Interferons

- Others

Others Market Size & Forecast (2023-2030), By Application, USD Million

- Oncology

- Autoimmune Diseases

- Diabetes

- Blood Disorders

- Growth Hormone Deficiency

- Infectious Diseases

- Others

Market Size & Forecast (2023-2030), By Manufacturing Type, USD Million

- In-house Manufacturing

- Contract Manufacturing

Market Size & Forecast (2023-2030), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde

Associate, Medi-Tech Insights

+32 498 86 80 79

info@meditechinsights.com