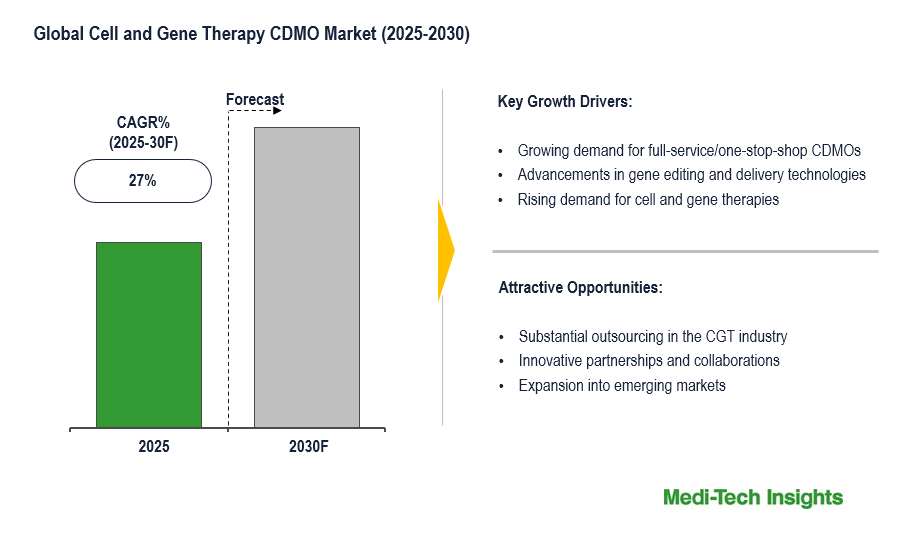

The global cell and gene therapy CDMO market is anticipated to witness a CAGR of ~27% during the forecast period, driven by the growing burden of cancer and other targeted diseases, rapidly expanding research on cell and gene therapies and robust CGT pipeline, substantial funding by venture capitalists, and technological innovations.

The development and approval of CAR-T cell therapies, such as Kymriah and Yescarta and their success in combating hematological malignancies have boosted investment in CGT. A robust CGT pipeline with a growing number of product approvals, strong support from large pharma and biotech, and consistent investor interest is set to boost the demand for CGT services. Also, a growing pipeline of therapies is nearing regulatory decisions. Additionally, CGT’s reach is expanding across new indications. For instance, newer CAR-T therapies like Abecma (idecabtagene vicleucel) and Carvykti (ciltacabtagene autoleucel), which were initially approved for multiple myeloma, are indeed expanding their indications beyond B-cell cancers.

To request a free sample copy of this report, please visit below

https://meditechinsights.com/cell-and-gene-therapy-cdmo-market/request-sample/

Growing demand for full-service/one-stop-shop CDMOs

Full-service CDMOs that can assist with both development and manufacturing are in high demand. Much of the gene therapy development has come from smaller biotech companies or research universities that rely on CDMOs from preclinical development through packaging. Big pharma and biopharma companies also prefer a full-service CDMO to speed up the timeline and free up resources to focus on innovation and marketing.

“There is growing demand for cell and gene therapy CDMOs who can offer integrated development, manufacturing, and testing services. For cell and gene therapy companies, outsourcing manufacturing and testing operations to a capable CDMO can reduce development timelines, provide supplementary capacity, and ultimately control costs.”- Senior Director, Tier 1 CGT CDMO, US

Greater focus on long-term strategic collaborations

The cell and gene therapy industry has witnessed a multi-fold rise in the number of collaborations between manufacturers/innovators and CDMOs in the form of joint ventures, manufacturing agreements, licensing agreements, service alliances, etc. For instance,

- In April 2025, Cell Therapies Pty Ltd and Xellera Therapeutics entered into a strategic partnership to accelerate the development and accessibility of cell and gene therapies across the Asia-Pacific region, focusing on expanding CGT access in Australia and Hong Kong through enhanced GMP manufacturing capabilities and collaborative innovation

- In October 2024, CytoImmune, a Biotechnology Company, established a strategic partnership with Matica Bio, a CDMO specializing in viral vectors, wherein Matica Bio will produce viral vectors at its GMP facility, and CytoImmune will manufacture its cell therapy in Puerto Rico, aiming to advance a clinical cell therapy program for cancer treatment

Substantial outsourcing in the CGT industry due to lack of internal capabilities

Cell and gene therapy is a highly specialized area that requires substantial production investments, advanced infrastructure, and highly skilled professionals. Many large pharmaceutical companies, despite their scale, often lack the ready-to-go infrastructure and technical setups required to manage these therapies internally. As a result, they turn to specialized CDMOs to assist them in the development and manufacturing of CGT therapies. Additionally, the surge in the number of small biotech companies entering the market without having their advanced manufacturing facility and technical expertise has further amplified the reliance on CDMOs. With only a limited number of CGT-focused manufacturers in the market, the gap between demand and supply has created a strong growth opportunity for CDMOs with specialized CGT capabilities.

North America is the largest and fastest growing region

North America is the largest and fastest-growing cell & gene therapy (CGT) CDMO market. It is expected to continue its leadership in the coming 5 years owing to growing manufacturing capacity for CGTs, favorable regulatory approval process, growing cell and gene therapy approvals per year, and strong product pipeline of CGTs in the U.S. The regulatory approval process in the US is evolving and becoming favorable for innovators for developing cell and gene therapy products. The US FDA is designating orphan drug status, breakthrough designation, accelerated approvals, and regenerative medicine advanced therapy (RMAT) designations for cell and gene therapies to expedite the approval process.

Competitive Landscape Analysis

The cell & gene therapy (CGT) CDMO market is marked by the presence of both established players and several small and mid-sized players. Some of the key players in the market include Lonza, Catalent, Inc. (acquired by Novo Holdings), Cytiva (Danaher Corporation), Samsung Biologics, Thermo Fisher Scientific Inc., Novartis AG, Charles River Laboratories, AGC Biologics, OmniaBio, Rentschler Biopharma SE, and WuXi AppTec, among several others.

🔗 Want deeper insights? Download the sample report here:

https://meditechinsights.com/cell-and-gene-therapy-cdmo-market/request-sample/

Global Cell and Gene Therapy CDMO Market Segmentation

This report by Medi-Tech Insights provides the size of the global cell and gene therapy CDMO market at the regional- and country-level from 2023 to 2030. The report further segments the market based on service type, product type and indication.

Market Size & Forecast (2023-2030), By Service Type, USD Million

- Clinical Development

- Commercial Manufacturing

Market Size & Forecast (2023-2030), By Product Type, USD Million

- Gene Therapy

- Ex-vivo

- In-vivo

- Cell Therapy

- Gene-Modified Cell Therapy

- CAR T-cell therapies

- CAR-NK cell therapy

- TCR-T cell therapy

- Other

Market Size & Forecast (2023-2030), By Indication, USD Million

- Oncology

- Neurological Disorders

- Infectious Diseases

- Rare Diseases

- Others

Market Size & Forecast (2023-2030), By Region, USD Million

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde

Associate, Medi-Tech Insights

+32 498 86 80 79

info@meditechinsights.com